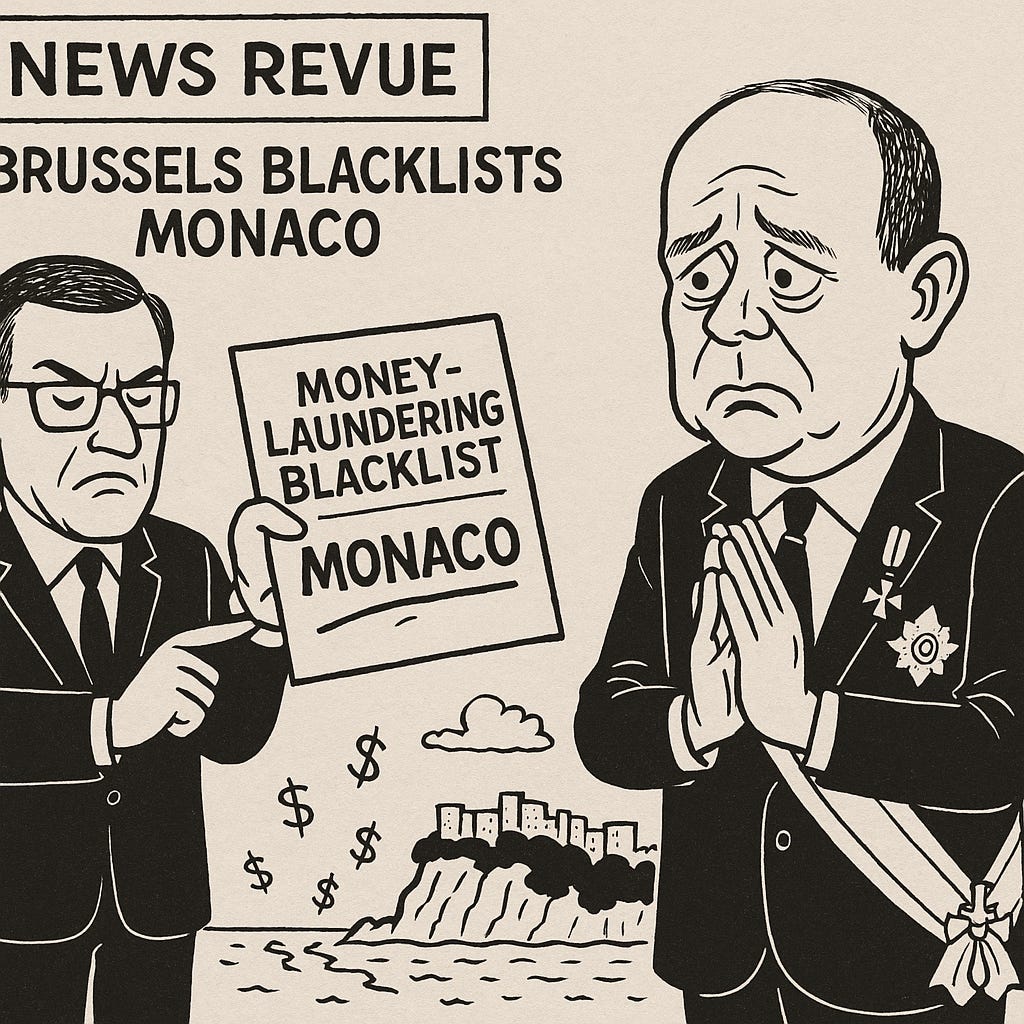

The EU has reportedly placed Monaco on its money-laundering blacklist, dealing a blow to the principality’s ambitions for financial respectability.

Monaco has officially been flagged by the European Union as a high-risk jurisdiction for money laundering and terrorism financing.

This comes after the Financial Action Task Force placed the principality on its grey list in 2024.

Despite creating a new financial watchdog last year, Monaco has shown little actual enforcement—its actions have been largely symbolic, with minor cases involving luxury watches and petty cash seizures.

(Same old, same old.)

Prince Albert’s push for international credibility is faltering.

Compounding the crisis is the messy internal feud between powerful real estate interests and the Prince’s inner circle, tainting the principality’s image with accusations of corruption.

Brussels’ blunt message: Monaco talks the talk but doesn’t walk it.

This reported blacklisting threatens to drive away legitimate business while leaving the underground economy largely unscathed.

Prince Albert faces a choice: enforce meaningful reforms—or risk becoming Europe’s version of Panama.

Either way, the shine is off The Rock.

My Monaco correspondent writes: “Blacklist status means near total financial isolation, severe sanctions, and a major blow to Monaco’s economy and reputation, with no clear path to relief until full compliance and cooperation are demonstrated.”

Prince Albert’s proclamation in July 2005 of “a new ethic” was a sham back then and, 20 years later, continues to be a sham.